What is value investing?

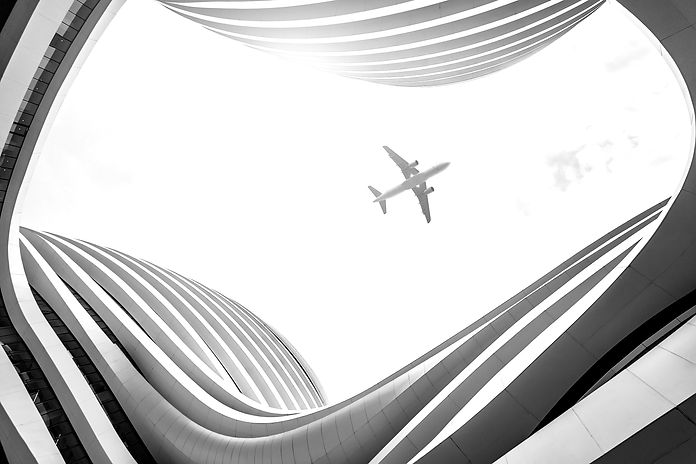

SIT BACK, RELAX,

AND ENJOY THE FLIGHT

Value Investing is just like taking a plane from Amsterdam to New York. Before selecting a flight, one will probably conduct research to find the right flight in terms of price, duration, and quality. You know in advance that the flight will take a while. You also know the destination (goal) and you are confident that you will reach your destination (goal). There might be turbulence along the way but it part of the journey. The same holds true for value investing. You conduct your research to make the best investment selection. Thanks to your research you are now confident of the future. There might be unfavorable developments on a macro or micro level that will rock the share price, but you hold steady. You are focused on the prize.

HISTORY

Value investing was invented in the 1920s by Benjamin Graham and David Dodd and was later popularized by Warren Buffett. This technique means that you purchase shares that are undervalued on the market. In other words, the stock is selling for (far) less than its worth. It becomes very cost effective to purchase these shares and to later sell them at their true value. In 1934, Benjamin Graham and David Dodd published the book Securities Analysis, which is considered the most important book for investors. This book makes a distinction between investing and speculating.

In 1949, Ben Graham published The Intelligent Investor in which he describes the important concept of Margin of Safety and introduced Mr. Market. Mr. Market symbolizes the inefficient marker hypothesis. There is a real difference in how stock markets are approached. Speculation is used to achieve a profit within the shortest possible time. Luck plays a very large role when it comes to speculation. Value investing on the other hand has the primary goal of preserving capital. This means that the investment approach leans more towards probabilities. Nothing is risk-free, but with a proper risk-reward ratio one keeps the risk low while ensuring good earnings potential.

EMOTIONS

Emotions (Behavioral finance) plays an important role in investments. A lot of people allow themselves to be misled by market signals or any other news. People like to go with the herd. If everyone is selling, they sell. If everyone is buying, they buy. Value investing is the exact opposite. Value investors are contrarian investors in the sense that they move against the herd. They buy when others are selling and sell when others are buying. In other words, value investors are not led by emotions but makes use of the irrational (emotional) decisions of the general market. A great example is the early stages of the COVID-19 pandemic. The general market was fearful and started a sell-off. Contrarian investors increased their investments as the prices were falling. Although the former may have recovered their losses, the latter likely made a huge profit.

It boils down to buying valuable companies at discounted prices. While emotional selling or buying directly affects a company’s price, it does not affect its value. As the discount becomes steeper the more we would like to buy in other markets like housing, auto, and other products & services. Why should we do it differently for stocks? By buying valuable companies at discounted prices, we limit our downside risk. In essence, we are securing our profit at the time of purchase.

WHAT DO WE

INVEST IN?

We do not merely look for companies trading at discounted prices. We look for companies with products and services that are the backbone of the economy. Companies that are able to sustain sales and profits no matter the economic cycles. In addition to these we look for companies with high quality management teams, solid balance sheets, real underlying assets, projectable free cash flows, competitive advantages to name a few. Companies are thoroughly researched and valued by our team to determine the discount rate.

WARREN BUFFETT

& BERKSHIRE HATHAWAY

Warren Buffett is one of the most renowned investors in the world and is known for his value investing approach. Value investing was invented in the 1920s by Benjamin Graham and David Dodd and was later popularized by Warren Buffett. This technique means that you purchase shares that are undervalued on the market. In other words, the stock is selling for (far) less than its worth. It becomes very cost effective to purchase these shares and to later sell them at their true value.

Warren Buffett is the general director of Berkshire Hathaway, an investment conglomerate that holds shares of other publicly traded companies and own some companies out right. Buffett is known for his down to earth way of doing business. The key to his success is the way in which he selects the companies. Buffett has an excellent insight into companies. He naturally applies certain criteria and in addition he has very good business instincts.

Buffett’s investment strategy enabled him to consistently beat the Standard & Poor's 500 (S&P500) by an annual average of twice the rate (10% vs 20%). The S&P500 index provides a reliable image of the developments in the United States stock exchange markets. Buffett’s initial goal was a compound annual growth rate of 15%. It is clear that he exceeded his goal by far. The result is even more impressive if you consider the fact that these are results after tax. The income tax and levies on the achieved increase have been deducted, while the S&P 500 does not take the tax into account.

THE BIOGRAPHY OF

WARREN BUFFETT

Warren Buffett was born on August 30, 1930, in Omaha, Nebraska. His father, Howard Buffett, was a stockbroker and U.S. congressman. From an early age, Warren showed a strong interest in numbers. At age six, he began selling cans of Coke, earning a 16% profit. By eight, he was reading books on investing and had bought his first shares—Cities Service Preferred.

While living in Washington, D.C., due to his father’s political role, Buffett became a true entrepreneur. At 13, he held two paper routes and used his earnings to buy secondhand pinball machines, placing them in barbershops. These machines earned $50 a week. He also bought a 1934 Rolls Royce for $350 and rented it out for $35 a day. By the time he finished high school at 16, he had saved $6,000.

The book The Intelligent Investor by Benjamin Graham made a deep impression on Buffett during his studies at Wharton and later Columbia Business School, where he studied under Graham. After earning his MBA, Buffett returned to Omaha to work at his father’s brokerage but stayed in contact with Graham. In 1954, Graham invited him to join the Graham-Newman Corporation in New York. Buffett accepted but eventually left in 1956 due to creative differences. Back in Omaha, at just 25 years old, he founded his own investment partnership with $105,000 from seven partners, contributing only $100 himself.

Buffett managed the fund conservatively, promising to invest based on value rather than popularity. Over 13 years, he achieved an average annual return of 29.5%, outperforming the Dow Jones Index in most years. He kept 25% of the profits above a 7% annual return, distributing the rest to partners.

In 1961, Buffett bought Dempster Mill Manufacturing, followed by Berkshire Hathaway, a textile company. His success attracted more investors, and in 1962, he merged all his partnerships into one firm headquartered at Kiewit Plaza, Omaha. By 1965, the company’s assets had grown to $26 million.

Buffett eventually gained full control over Berkshire Hathaway with a $25 million investment. Though the textile business struggled in the 1980s due to global competition and inflation, Buffett decided to shut it down in 1985. He later reflected, “Turnarounds seldom succeed.” Still, Berkshire had already generated enough capital to acquire an insurance company, laying the foundation for what would become one of the most successful investment firms in history.

The rest, as they say, is history.